Wednesday, October 27, 2004

Channel Strategy: Segway Does 180 Degree Turn and Signs up Dealer Channel

After three years, Segway has changed its channel strategy and licensed 60 dealers. Why? Because you cannot sell a product that has to be experienced over the internet. Regardless of how cool it is.

I have nothing against Amazon (except slow servers), but it was not sufficient as a channel for Segway. Channels are good for supply, access or demand. Want to reduce the cost of distribution? Then get into an existing supply chain. Want to reduce the sales cycle? Then get in front of decision makers? Want to launch a product? Then get sales people who can help customers experience the product.

Amazon is great for supply and consumer access but was a dumb choice because the Segway HT is a product that needed experience (also known as product demonstration) and access to buyers in enterprise businesses. Too bad they did not have a channel in place to take advantage of all the PR hype they created 3 years ago.

Segway is now bringing its next product, a four-wheeled HT ATV code named Centaur, to market. Chances they will build the right channel are low. Popular Science quotes Segway Chief Technology Office Doug Field "Real breakthroughs never occur from market pull or business briefings." When it comes to channel development, attitudes like this are the reason 99% of product launches fail.

Centaur sound fun and cool. The right channel and promotion could take Segway and Centuar off the futuristic pages of Popular Science and into users homes and businesses.

Scott Karren, The Channel Pro

0 comments

After three years, Segway has changed its channel strategy and licensed 60 dealers. Why? Because you cannot sell a product that has to be experienced over the internet. Regardless of how cool it is.

I have nothing against Amazon (except slow servers), but it was not sufficient as a channel for Segway. Channels are good for supply, access or demand. Want to reduce the cost of distribution? Then get into an existing supply chain. Want to reduce the sales cycle? Then get in front of decision makers? Want to launch a product? Then get sales people who can help customers experience the product.

Amazon is great for supply and consumer access but was a dumb choice because the Segway HT is a product that needed experience (also known as product demonstration) and access to buyers in enterprise businesses. Too bad they did not have a channel in place to take advantage of all the PR hype they created 3 years ago.

Segway is now bringing its next product, a four-wheeled HT ATV code named Centaur, to market. Chances they will build the right channel are low. Popular Science quotes Segway Chief Technology Office Doug Field "Real breakthroughs never occur from market pull or business briefings." When it comes to channel development, attitudes like this are the reason 99% of product launches fail.

Centaur sound fun and cool. The right channel and promotion could take Segway and Centuar off the futuristic pages of Popular Science and into users homes and businesses.

Scott Karren, The Channel Pro

0 comments

Thursday, October 21, 2004

Channel Marketing: In Home Parties Crash Retail

Forbes had a great article on a channel often ignored by the technology industry--The In-Home Sales Channel, The Party That Crashed Retail. (I only linked to Forbes.com. You have to be a member to see articles. Membership s free, then you can search by article name.) The article is about Pure Romance, a company that sells sex toys to women. According to the Direct Selling Association direct sales exceeded $30 billion in 2003 with 28.5% of that coming from party sales.

I have long used Tupperware to explain channels, channel conflict and channel strategy to people. I like the Tupperware example because it not only is a company everyone knows but also shows how a company struggles to adapt to changes in its market and the consequences of its choices. As women entered the job market, many had less time for the Tupperware parties. Convenience made more sense than socializing at the party. Rubbermaid, with it products in grocery stores cleaned up on market share. Tupperware has made half-hearted retail attempts, usually retreating in the face of channel conflict and lackluster sales. Forbes cites that Tupperware "recently pulled its plastic wares from Target."

Two questions that occurred to me when I read the article are:

1. How can a company built on one channel (e.g. Tupperware with a multi-level marketing (MLM) party channel or Cisco with a telco/solution provider channel?) adapt to market changes and transition from one channel to another?

Making the transition from one channel to another is one of the hardest things a company can attempt. It is often a complete change for the company impacting the entire go-to-market strategy that made the company successful in the first place. First, the change is usually crisis induced. A competitor takes huge amounts of market share Then sales level off or plummet, creating a sales crisis. This is compounded by what I call incumbent disease. Internally, the existing channel fights the change and reductions to its budget. Externally, conflict existing dealers can decimate sales as they fight to retain exclusivity. It is no wonder that most companies make ill-planned, poorly-executed attempts and fail to make the transition a la Tupperware.

2. What makes the MLM party channel appropriate?

Many companies use MLM party channels to sell their products. In addition to adult products, Forbes states "pate, pet food, saws, cosmetics, scrapbooks, air filters, legal services, expensive appeal, wine and golf clubs are sold the same way as Mary Kay Cosmetics." Clearly it is not just a gimmick to sell products to women. Although often explained as best suited for products that need explanation, that is not usually the case. Do people really need to be shown how to put a lid on a Tupperware container? The real reasons are usually convenience, socializing, privacy or emotional safety.

The only way I know to make channel marketing work without conflict is to get clear on your objectives, the channel requirements and the customer. By linking all of these together you get sell through.

The Channel Pro

0 comments

Forbes had a great article on a channel often ignored by the technology industry--The In-Home Sales Channel, The Party That Crashed Retail. (I only linked to Forbes.com. You have to be a member to see articles. Membership s free, then you can search by article name.) The article is about Pure Romance, a company that sells sex toys to women. According to the Direct Selling Association direct sales exceeded $30 billion in 2003 with 28.5% of that coming from party sales.

I have long used Tupperware to explain channels, channel conflict and channel strategy to people. I like the Tupperware example because it not only is a company everyone knows but also shows how a company struggles to adapt to changes in its market and the consequences of its choices. As women entered the job market, many had less time for the Tupperware parties. Convenience made more sense than socializing at the party. Rubbermaid, with it products in grocery stores cleaned up on market share. Tupperware has made half-hearted retail attempts, usually retreating in the face of channel conflict and lackluster sales. Forbes cites that Tupperware "recently pulled its plastic wares from Target."

Two questions that occurred to me when I read the article are:

1. How can a company built on one channel (e.g. Tupperware with a multi-level marketing (MLM) party channel or Cisco with a telco/solution provider channel?) adapt to market changes and transition from one channel to another?

Making the transition from one channel to another is one of the hardest things a company can attempt. It is often a complete change for the company impacting the entire go-to-market strategy that made the company successful in the first place. First, the change is usually crisis induced. A competitor takes huge amounts of market share Then sales level off or plummet, creating a sales crisis. This is compounded by what I call incumbent disease. Internally, the existing channel fights the change and reductions to its budget. Externally, conflict existing dealers can decimate sales as they fight to retain exclusivity. It is no wonder that most companies make ill-planned, poorly-executed attempts and fail to make the transition a la Tupperware.

2. What makes the MLM party channel appropriate?

Many companies use MLM party channels to sell their products. In addition to adult products, Forbes states "pate, pet food, saws, cosmetics, scrapbooks, air filters, legal services, expensive appeal, wine and golf clubs are sold the same way as Mary Kay Cosmetics." Clearly it is not just a gimmick to sell products to women. Although often explained as best suited for products that need explanation, that is not usually the case. Do people really need to be shown how to put a lid on a Tupperware container? The real reasons are usually convenience, socializing, privacy or emotional safety.

The only way I know to make channel marketing work without conflict is to get clear on your objectives, the channel requirements and the customer. By linking all of these together you get sell through.

The Channel Pro

0 comments

Tuesday, October 12, 2004

Channel Programs: Dell Sets Performance Benchmark for Product Positioning

A lot of people wondered why we included Dell in our POWER Channel Awards for channel programs.

"Doesn't Dell sell direct?"

We included them for two reasons. First, a lot of channel providers work with Dell to fulfill product to their customers. That is channels. Second and more important, Dell sells to the same customers as the channel, but often more effectively. That is channel performance. Channel vendors and channel providers have much to gain by understanding what Dell does well.

And what Dell does the best is get quality products to users. Day in and day out Dell builds demand at the end user level. This demand is what compels reluctant channel providers to work with Dell, a company most of them love to hate. Dell's program sets market price expectations, customer quality expectations and after market service expectations. In 2004, Dell continued to change the way people and businesses bought computer technology and services. That is Product positioning in the channel.

Congratulations to Dell on earning a nomination in the POWER Channel Awards.

The Channel Pro

0 comments

A lot of people wondered why we included Dell in our POWER Channel Awards for channel programs.

"Doesn't Dell sell direct?"

We included them for two reasons. First, a lot of channel providers work with Dell to fulfill product to their customers. That is channels. Second and more important, Dell sells to the same customers as the channel, but often more effectively. That is channel performance. Channel vendors and channel providers have much to gain by understanding what Dell does well.

And what Dell does the best is get quality products to users. Day in and day out Dell builds demand at the end user level. This demand is what compels reluctant channel providers to work with Dell, a company most of them love to hate. Dell's program sets market price expectations, customer quality expectations and after market service expectations. In 2004, Dell continued to change the way people and businesses bought computer technology and services. That is Product positioning in the channel.

Congratulations to Dell on earning a nomination in the POWER Channel Awards.

The Channel Pro

0 comments

Monday, October 11, 2004

Channel Programs: Winners of the 2004 POWER Channel Awards

Not all channel programs are the same. What we found in our interaction with resellers and vendors was that some companies are doing a much better job than others at creating productive channels. These companies are case studies in channel management and deserve close attention by the rest of the channel.

The POWER Channel Awards are divided into five categories: Product and positioning, Objectives, Working Capital, Expenses and Returns. Each company listed in our awards is there because it shows a specific area of excellence. Below are the nominees for each of these categories.

Product and Positioning: Cisco, Red Hat, Novell/SuSE, Intel and Dell

Objectives: Microsoft, Avaya, and Cisco

Working Capital: Seagate, Cisco, and IBM

Expenses: HP, Xerox, and Intel

Returns: Cisco, Microsoft, Avaya

We will publish posts about each of the nominees and what we liked about their programs over the next couple weeks. Final awards for each category will be announced at the end of October.

The Channel Pro

0 comments

Not all channel programs are the same. What we found in our interaction with resellers and vendors was that some companies are doing a much better job than others at creating productive channels. These companies are case studies in channel management and deserve close attention by the rest of the channel.

The POWER Channel Awards are divided into five categories: Product and positioning, Objectives, Working Capital, Expenses and Returns. Each company listed in our awards is there because it shows a specific area of excellence. Below are the nominees for each of these categories.

Product and Positioning: Cisco, Red Hat, Novell/SuSE, Intel and Dell

Objectives: Microsoft, Avaya, and Cisco

Working Capital: Seagate, Cisco, and IBM

Expenses: HP, Xerox, and Intel

Returns: Cisco, Microsoft, Avaya

We will publish posts about each of the nominees and what we liked about their programs over the next couple weeks. Final awards for each category will be announced at the end of October.

The Channel Pro

0 comments

Channel Communication: Are you Taking Advantage of the Latest Technology?

The perspective of Microsoft's Channel 9 Guy is that he's bigger than Seattle. Here he is sitting on top of Quay Cat's GPS antenna in Elliot Bay with the Space Needle in the background. Robert Scoble was kind enough to bring Channel 9 Guy along on yesterday's Geek Boat Trip.

Channel9 guy keeps up with the latest technology. How about you?

Seriously though, there are a host of new technologies that can be used to build community and loyalty in the channel. Are your program and field ready?

The Channel Pro

0 comments

The perspective of Microsoft's Channel 9 Guy is that he's bigger than Seattle. Here he is sitting on top of Quay Cat's GPS antenna in Elliot Bay with the Space Needle in the background. Robert Scoble was kind enough to bring Channel 9 Guy along on yesterday's Geek Boat Trip.

Channel9 guy keeps up with the latest technology. How about you?

Seriously though, there are a host of new technologies that can be used to build community and loyalty in the channel. Are your program and field ready?

The Channel Pro

0 comments

Wednesday, October 06, 2004

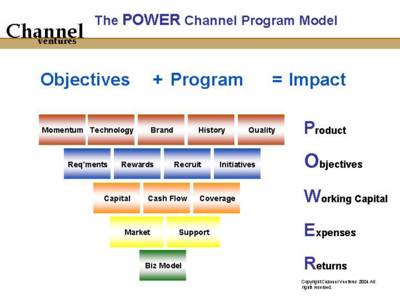

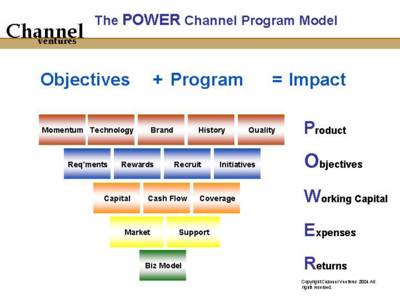

Channel Programs: The POWER Channel Program Model

Many vendor programs address only the more basic channel needs shown in red and blue. This is one of the reasons so many programs offer so little differentiation. Furthermore, programs built to support yesterday's products and channel segments need more than small adjustments; they need to be redesigned.

Channel Ventures is recognizing the vendors doing the most with their channel programs to improve the productivity of the channel with our 2004 POWER Channel Awards.

The Channel Pro

0 comments

Many vendor programs address only the more basic channel needs shown in red and blue. This is one of the reasons so many programs offer so little differentiation. Furthermore, programs built to support yesterday's products and channel segments need more than small adjustments; they need to be redesigned.

Channel Ventures is recognizing the vendors doing the most with their channel programs to improve the productivity of the channel with our 2004 POWER Channel Awards.

The Channel Pro

0 comments

Monday, October 04, 2004

Channel Programs: Mistakes Vendors Make with Programs

Often vendors recognize something has gone wrong with their channel programs. Deciding what to do about it is more frequently where they make mistakes. Below are some of the most common mistakes we have seen when it comes to channel programs.

0 comments

Often vendors recognize something has gone wrong with their channel programs. Deciding what to do about it is more frequently where they make mistakes. Below are some of the most common mistakes we have seen when it comes to channel programs.

- Our program is perfect, it even won an award. Programs get stale. Keeping the value proposition relevant as technology and markets change is an ongoing process. Even if you have the best program, it will not stay fresh without substantial change over time.

- What's my competitor doing? Almost everyone asks me this question. Although many of the program elements are similar, each company needs a unique program. Copying a competitor's program is no more successful than plagiarizing a competitor's ads and marcom. Instead of copying, look to address competitive requirements.

- How do I fix a specific element (e.g. MDF, rebates, support, recruitment, morale)? This is a trick question. It is a rare program that has only a broken element. These are symptoms of misalignment between the program, vendor objectives and market requirements. Broken elements are warning lights to address deeper issues.

- The Ideal Program Myth. Programs can be flawed and still work. Instead of looking for a soul mate, comprimize and move on. Make sure the most important partner needs are addressed and ignore the rest.

- Segmentation doesn't equal business knowledge. It is a rare account rep that really understands the subtle business issues of his or her accounts. Furthermore, knowledge in aggregate about the segment is not sufficient to change behavior in the field. Incremental demand comes only when the the field can apply the program to individual partner problems.

- Can you give us a day of training? Training without clear objectives and management support is a waste of time. "Boil the ocean" approaches where 10 to 15% of the account reps actually apply what they learn is not a cost effective way to manage a sales force. Hit and run training never yields a true ROI, regardless of the case studies and testimonials.

Channel Ventures POWER Channel Program Model helps vendors create programs that avoid these traps.

The Channel Pro

0 comments